Although the state of the water recycling business in oil and gas is in its infancy; it has gotten substantial traction with producers seeking fluids for fracs and wanting to minimize the impact to the local environment. Some predict that worldwide demand for fresh-water could increase 55% by 2050. With 70% of fresh-water resources going to agriculture, this will put a strain on the industrial and mining sectors of the world economy. As mentioned in our previous blog, oil and gas producers would be trailblazers to accept the new-norm and look for ways to better utilize resources. If the process is optimized, these modern ways of utilizing water can result in a net savings throughout the industry.

Although the state of the water recycling business in oil and gas is in its infancy; it has gotten substantial traction with producers seeking fluids for fracs and wanting to minimize the impact to the local environment. Some predict that worldwide demand for fresh-water could increase 55% by 2050. With 70% of fresh-water resources going to agriculture, this will put a strain on the industrial and mining sectors of the world economy. As mentioned in our previous blog, oil and gas producers would be trailblazers to accept the new-norm and look for ways to better utilize resources. If the process is optimized, these modern ways of utilizing water can result in a net savings throughout the industry.

Oil and gas use of fresh-water in the fracking process only compiles the issue of significant net withdrawals of resources. According to Stephen McNair of H2O Midstream; on average, it takes approximately 12 billion gallons of water per frac job. The USGS estimates that the average person in the US uses approximately 100 gallons per day. That means each frac is equivelant to the water usage of 329,000 citizen's yearly water usage.

So, does this mean this is a problem for oil and gas? Yes, and no.

Behind every problem is an opportunity, and that's why producers have been looking at ways to optimize their water project management programs. This focus on optimization not only reduces fresh-water usage, but also saves money. Newfield was one of the first in Oklahoma to announce they would be recycling produced water. This coupled with Devon Energy's option to purchase up to 25 million gallons per day of recycled Oklahoma City water, demonstrates operator's eagerness to get ahead of the potential shortages. If oil and gas can work through the challenges there are large gains in:

- Savings in water costs per well

- Reduced oil and gas trucking related to water hauling; a sore spot for some local communities

- Reduced use of local, fresh-water resources that can be allocated to other use

Although there has been much success, there are still challenges to overcome:

- Regulatory and liability issues with selling water between producers

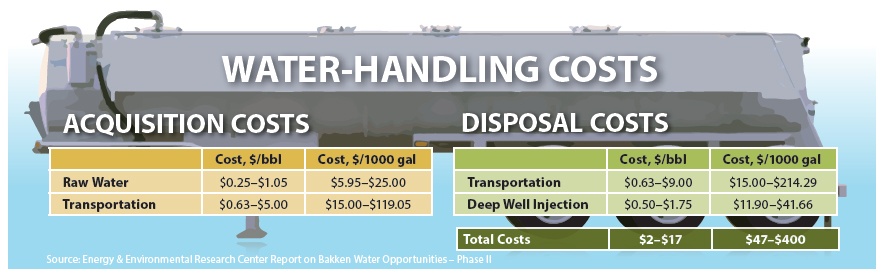

- High transportation costs and a lack of pipeline infrastructure

- Cost to treat produced water, desalinization costs twice as much as evaporation

Those that embrace change and get ahead of this issue will likely be the ones that claim the greatest benefits. Laura Capper, Founder of Cap Resources, believes a "New industry will come from operators figuring out how to deal with water management issues."

The Gateway Companies has learned that the only constant in oil and gas since 1997 is change.

Hence; we have vertically integrated services from land survey through pipeline construction to ease the burden on customers in a changing environment. Through the years, Gateway has also added additional services to our offerings like directional boring, hydro-excavation, and LiDAR. We also know that there isn't a one-size fits all in oil and gas, so we have trained our team on constructing pipelines of steel, poly-pipe, flex-steel and fiberglass.

Just like the fracking revolution brought about great changes and opportunities to the oil and gas industry; water management has the same potential. There was a day when natural gas was thought of as a byproduct of oil exploration, and now it is a commodity. I suspect that water is well on its way through that same process.